Tesla, the world's most valuable carmaker, has warned that its prices will continue to "evolve" as it faces strong demand and supply chain challenges. The electric vehicle (EV) maker raised the prices of some of its models in the US and Europe several times this year, citing rising costs of raw materials and transportation.

Tesla CEO Elon Musk said on Twitter that the company is trying to balance affordability and profitability while also investing in new technologies and factories. "We are not artificially inflating prices. We are trying to make our cars as affordable as possible," he tweeted.

Tesla leads the EV market

Tesla has been enjoying a surge in sales and deliveries of its EVs, despite the global semiconductor shortage and the pandemic-related disruptions.

In the third quarter of 2023, Tesla delivered a record 241,300 vehicles, up 20% from the previous quarter and 72% from a year ago.

The company also reported a net income of $1.62 billion for the quarter, beating analysts' expectations and marking its ninth consecutive profitable quarter.

Tesla's strong performance has boosted its stock price, which has risen more than 40% this year. The company's market capitalization is currently over $1 trillion, making it one of the most valuable companies in the world.

Tesla's success has also spurred competition from other automakers, both traditional and new entrants, who are ramping up their EV offerings.

According to a report by J.D. Power, Tesla accounted for 58% of the US EV market in the first nine months of 2023, followed by Ford with 15% and General Motors with 9%.

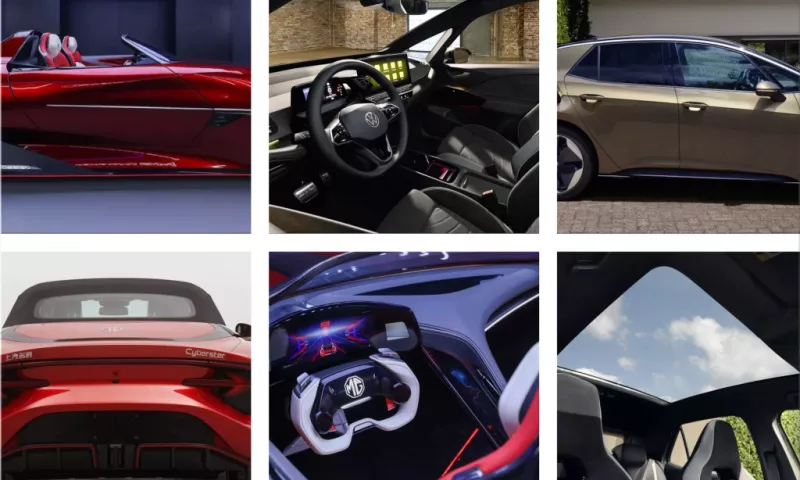

However, Tesla's dominance may be challenged by new models from rivals, such as Ford's Mustang Mach-E, Volkswagen's ID.4, and Hyundai's Ioniq 5.

Tesla adapts to changing conditions

Tesla has been known for its frequent price changes, reflecting its dynamic pricing strategy and ability to adapt to changing market conditions.

The company does not rely on dealerships or advertising to sell its cars but rather sells them directly to customers through its website or stores.

This gives Tesla more flexibility and control over its pricing, as well as more data and feedback from customers.

Tesla also uses software updates to enhance its vehicles' features and performance, which can increase their value and appeal over time.

However, some analysts and customers have criticized Tesla's frequent price changes, saying they create uncertainty and confusion.

Some customers have complained that they paid more for their cars than others who ordered later or earlier or that they missed out on discounts or incentives.

Some analysts have also questioned Tesla's pricing strategy, saying it may hurt its brand image and customer loyalty.

They argue that Tesla should adopt a more stable and transparent pricing policy or offer more options and customization for its customers.